THE Penang government has officially gazetted new quit rent tax rates for the entire state under Section 101 of the National Land Code (Act 828), as published in the Penang Government Gazette No. 37 dated Sept 11, 2025.

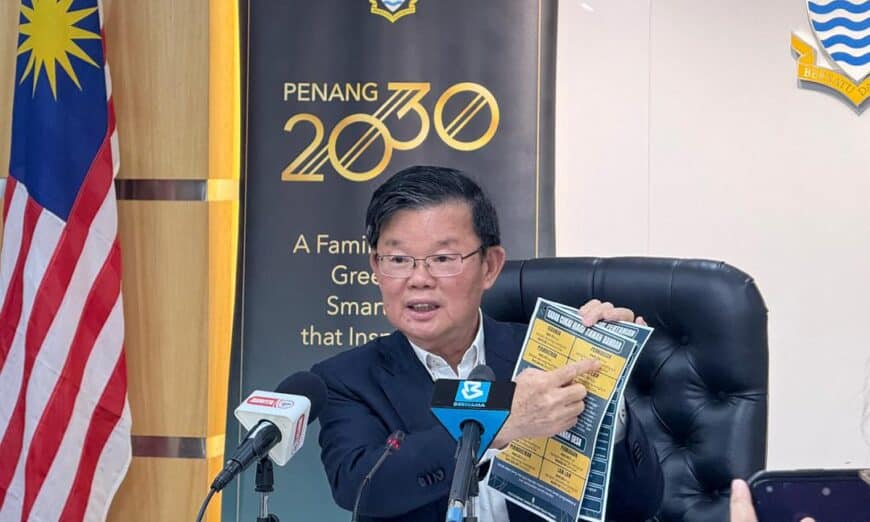

Chief Minister Chow Kon Yeow said the revised quit rent tax rates will take effect from January 1, 2026, covering nearly 370,000 land titles across Penang.

“The new rates, which were approved by the National Land Council in 2024, will remain in force for a minimum of 10 years.

“The next review will only be conducted after that period, meaning the revised quit rent tax rates effective Jan 1, 2026, will remain unchanged until the following review,” Chow told a press conference at Komtar today.

He explained that the revision was necessary as quit rent tax rates had not been reviewed for the past 30 years.

“The last review was conducted in 1994, which means the state government skipped two review cycles in 2004 and 2014. This long delay prevented the government from increasing land tax revenue over an extended period.

“In addition, arrears and leakages in land tax collection also grew as data cleansing efforts could not be comprehensively implemented,” Chow said.

Chow clarified that the revision does not affect the 300,000 strata parcel accounts, where owners will continue paying their existing parcel-based tax.

Instead, he said the review is primarily targeted at industrial and commercial land, which has provided substantial returns to landowners.

“Industrial and commercial landowners enjoy significant income potential from their properties. Therefore, the new tax adjustment will mainly focus on these two categories.

“For residential and agricultural landowners, the impact will be relatively smaller. For instance, the minimum rate for residential land in urban areas will only rise from RM40 to RM50,” he added.

Chow added that to ease the financial impact on all landowners in Penang, the state government has introduced a quit rent rebate mechanism starting in 2026.

He said that a 32.5% quit rent rebate will be implemented in 2026, followed by a 20% rebate in both 2027 and 2028.

He said the rebate will benefit all landowners in the state, regardless of land category or usage.

“However, landowners who qualify for the rebate must continue paying the existing quit rent rate if the amount payable after rebate is lower than what was paid in 2025.

“On average, the rebates will result in a revenue shortfall of between RM80 million and RM100 million annually for the Penang government from 2026 to 2028,” Chow said.

Chow also revealed that apart from the three-year rebate scheme, the state government has agreed to roll out several additional incentives for Penang landowners.

“Among them are full waiver of penalty charges on arrears for quit rent and strata parcel taxes between Jan 1 and Dec 31, 2026.

“This waiver, amounting to about RM25 million, is intended to encourage landowners to settle their outstanding dues.

“Next is the 50% discount on land conversion premiums from agricultural use to residential use (for individual housing only, subject to planning guidelines).

“This incentive, available throughout 2026, aims to help agricultural landowners in designated development zones convert their lots where farming activities have ceased and houses have already been built,” he said.

Chow said this will also help landowners enhance the value of their property and private residences.

“The third incentive is the attractive rewards and lucky draws for quit rent and strata parcel taxpayers who pay online via the PG Land application.

“This measure is meant to promote digital payment adoption among landowners,” he said.

Chow stressed that with the revised rates in place from 2026, the state government expects a significant boost in revenue.

“This will strengthen our capacity to provide more financial incentives and long-term cost-of-living support for the people of Penang,” he said.

Story by Riadz Akmal

Pix by Darwina Mohd Daud

Video by Law Suun Ting