THE Penang government continues to assist the small and medium-sized enterprises (SMEs) in the state with the introduction of ‘PEKA PKS 3.0’, which is the interest-free loan scheme launched in October this year.

The programme was initiated by the state government to help ease the financial burden of SMEs, primarily those who have lost their source of income during the implementation of the movement control order 3.0 (MCO 3.0).

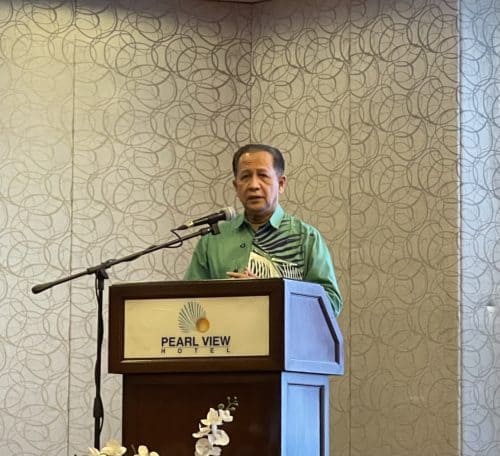

State Entrepreneurial Development, Trade and Industry Committee chairman Datuk Abdul Halim Hussain said a total of 409 individuals have had their loan application approved.

“The loan application, which was done online, was open earlier from Oct 7 till Oct 29. It was managed by the Penang Development Corporation (PDC).

“The interest-free loan ranges from a minimum of RM5,000 to a maximum of RM20,000 and will be given a time frame of 30 months to pay back.

“This includes the moratorium period of six months.

“The recipients will start receiving their payment starting from today until January 2022,” Abdul Halim said during his speech at the PEKA PKS 3.0 briefing session held at the Pearl View Hotel today.

Abdul Halim said the state government has allocated RM5 million for the ‘PEKA PKS 3.0’ loan scheme and hopes it would help the SMEs to bounce back in their businesses.

“We (state government) understand the hardships that all of you had to go through due to the implementation of the MCO 3.0 in January.

“Thus, we hope that the loan offered under the ‘PEKA PKS 3.0’ would help to revive your businesses.

“Apart from that, last year the state government had also introduced the ‘Tabung Pinjaman PEKA PKS 1.0’ and ‘Tabung Pinjaman Pelancongan PEKA 2.0’ with the total fund of RM30 million and RM10 million respectively.

“The state government will do its best to help revive the livelihoods of the SME traders,”he added.

Story & Pix by Tanushalini Moroter