CYBERCRIME is becoming an alarming issue across the globe, and Penang is no exception to this trend, largely because of the pervasive influence of technology in today’s modern world.

According to findings from the authorities, non-existent investment schemes top the list with the highest recorded losses of RM20,561,486.61 in Penang from January to March this year (2024).

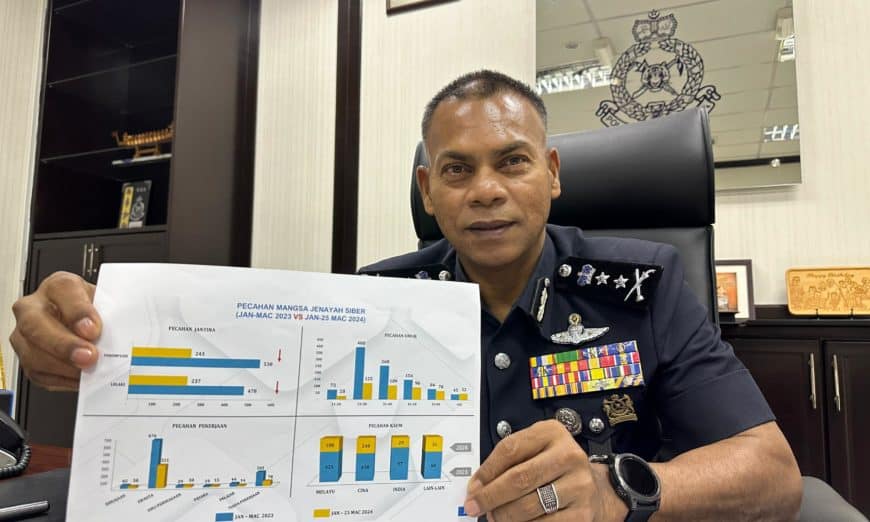

Penang deputy police chief Deputy Comm Datuk Mohamed Usuf Jan Mohamad said despite having recorded relatively lower cases compared to e-commerce, non-existent loan schemes and others, the losses attributed to investment scams this year were four times higher than in 2023 (January to March).

From January to March 2023, the state reported total losses of RM5,807,395.05 due to investment scams affecting numerous victims.

“When it comes to non-existent investments, individuals must be very careful to avoid falling prey to enticing offers that seem too good to be true.

“How can an individual gain 20% profit through an investment scheme overnight?

“Syndicates play the numbers game, and for the public to not fall prey, it is important to always have doubts and thoroughly check the sources and their credibility before making any commitments.

“These syndicates don’t necessarily operate within close distance; they could be in a different state or country. That is how they manipulate their potential victims,” Muhamed Usuf told Buletin Mutiara during an exclusive interview at the state contingent police headquarters (IPK) in George Town today.

In a breakdown, from January to March, the number of love scams surged from 22 in 2023 to 73 in 2024 and job scams increased from 25 in 2023 to 70 in 2024. Conversely, other scams like e-commerce (388 – 92), phone (119 – 42), Macau (97 – 47) and non-existent loans (261 – 58), saw a dip in reported cases.

Muhamed Usuf, with over 15 years of experience in the commercial crime unit, said that social media platforms have turned into a nice plate of dishes for scammers to hunt for their prey.

“Social media has become a tool of expression for many, and without us knowing, these scammers exploit these emotions conveyed therein to their advantage.

“Our intentions may be good but our online exposure renders us vulnerable to unforeseen approaches, inviting trouble that jeopardise our safety, whether monetary or otherwise.

“We need to understand that scammers don’t trap their prey overnight. They develop a character to approach their victims, and when that character becomes a convincing one, that’s when all the problem starts.

“For instance, love scams have grown to become very popular in this modern era, with scammers exploiting emotions to manipulate individuals at their most vulnerable.

“This is one of the ways potential victims can fall prey to scammers by providing them with the opportunity to craft compelling narratives to achieve their objectives.

“From January to March in 2023 and 2024, we observed a dip in cases of victims among men and women, with the number decreasing from 538 to 243 among women and from 478 to 237 among men.

“Furthermore, our findings also stated that a high number of cases involved individuals between the ages of 21 and 30 and those working in the private sector,” he added.

Muhamed Usuf also mentioned that there was a decrease of 6.3% in the number of police reports received between 2023 and 2024.

From January to March 2023, a total of 3,331 reports were received compared to 3,123 reports in 2024.

In line with this trend, he reaffirmed the commitment of the Penang police department to maintain a proactive stance in tackling scams within the state. This includes ongoing initiatives such as engaging with the public through meet-and-greet sessions, conducting walkabouts, organising awareness campaigns, exhibitions and similar efforts.

Story by Kevin Vimal

Pix by Muhamad Amir Irsyad Omar